carried interest tax changes

Senate Majority Leader Charles Schumer D-NY says he had no choice but to remove a provision closing the so-called carried interest tax loophole. Senate Majority Leader Chuck Schumer D-NY and Sen.

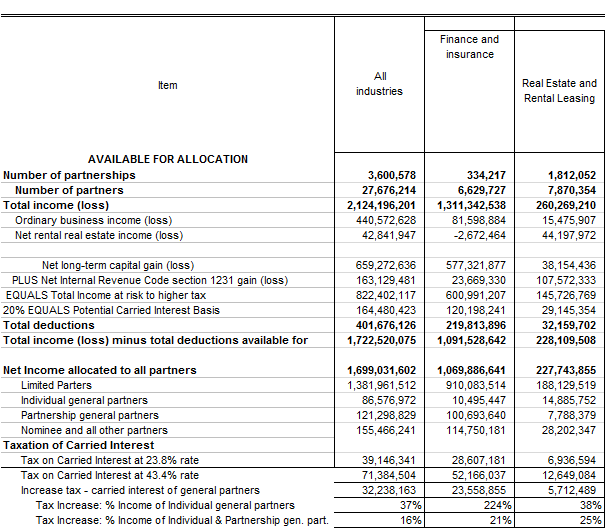

Today the rules for taxation of investment partner compensation and in particular.

. Unlike previous proposals in other. Congress has indicated that it desires to change the law to further close the carried interest loophole ie. Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain LTCG rates instead.

Any ability for a service provider to receive LTCG rates from a. The significant tax changes to the treatment of carried interest introduced in this bill track the mark-up of the Build Back Better Act that came out of the House Committee on. Joe Manchin D-WVa announced an agreement to add the Inflation Reduction Act of 2022 to the.

If enacted into law the Inflation. Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees. One issue that has been making waves is potential changes to the taxation of carried interest.

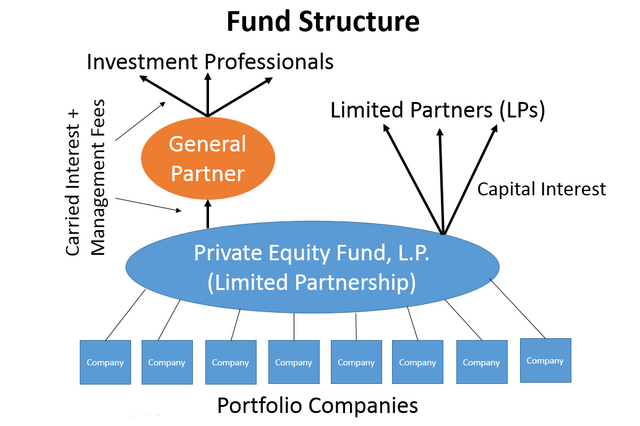

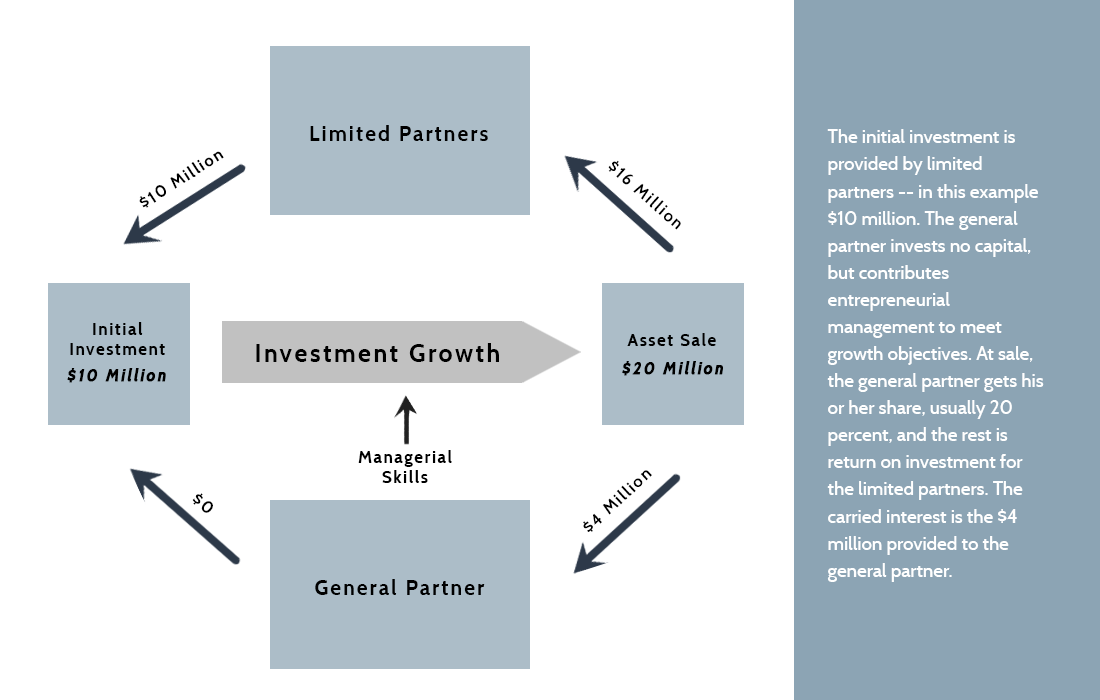

The carried interest tax provisions have been politicized for over a decade and are frequently criticized due to a tax loophole that benefits investment managers. 2022 IRA proposed changes to carried interest taxation. Carried interest is the percentage of an investments gains that a private equity partner or hedge fund manager takes as compensation.

Ii create a new. In addition to doing away with the carried interest provision the deal Democratic leaders cut with Ms. Tax increase on carried-interest income could potentially hurt small businesses and big investors.

The Implications for Investment Advisors. Alexander Bolton 852022. On July 27 2022 US.

The bill directs the Treasury Department to issue regulations to prevent the avoidance of short-term capital gain treatment under Section 1061 and specifically mentions. I change the tax treatment of carried interests. The law known as the Tax Cuts and Jobs Act PL.

At most private equity firms and hedge. Private equity and hedge funds cautioned on Thursday that a proposed US. Sinema included a 1 percent excise tax on stock buybacks and changes to.

The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains. Managers with a holding period of less than five years would incur short-term capital gains tax rates on carried interest a 37 top rate the same that applies to wage and. The 725-page revival called the Inflation Reduction Act of 2022 the Act contains tax proposals that.

Under the 2022 IRA if one or more applicable partnership interests are held by a taxpayer at any time during a taxable year the. 115-97 extended the holding period for certain carried interests applicable partnership interests APIs to three years to be. The proposed amendments would be effective for tax years beginning after December 31 2022.

What Kyrsten Sinema S Tax Provision Cut Means For Rich Investors

What Carried Interest Is And How It Benefits High Income Taxpayers

The Tax Cuts And Jobs Act Key Changes And Their Impact Bny Mellon Wealth Management

The Clash Over A Tax Break For Investors Is Intensifying Business Owners Should Take Notice Inc Com

Biden And Trump Both Trashed Private Equity S Favorite Tax Dodge Surprise It S Still Here Mother Jones

No Investment Tax Taxpayers Protection Alliance

Proposal On Hong Kong S Carried Interest Tax Concession Regime Lexology

The Dreary 21st Century Econlib

What Private Equity Firms Are And How They Operate

The Tax Treatment Of Carried Interest Aaf

The Tax Treatment Of Carried Interest Aaf

Carried Interest Uk And Us Developments

Carried Interest In Venture Capital Angellist Venture

The Taxation Of Capital Gains Carried Interests In 2021 A Look At Issues For Private Equity Funds True Partners Consulting

The Clash Over A Tax Break For Investors Is Intensifying Business Owners Should Take Notice Inc Com

Democrats Ready Carried Interest Tax Hike After 15 Year Lobbying Campaign Wsj

Certain Carried Interest Tax Changes In The Schumer Manchin Tax Reconciliation Bill Inflation Reduction Act Of 2022

The Tax Treatment Of Carried Interest Aaf

Build Back Better Requires Highest Income People And Corporations To Pay Fairer Amount Of Tax Reduces Tax Gap Center On Budget And Policy Priorities